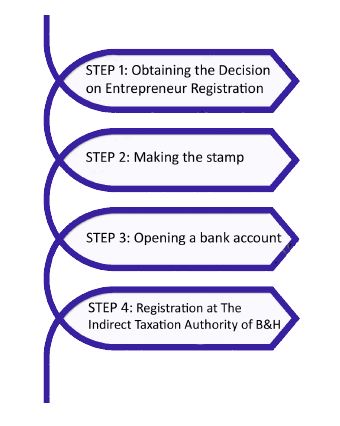

COMPANY REGISTRATION PROCEDURE

STEP 1

Procedure 1: Visit the Notary/Notary Certified Founding Act

Visit the Notary with a copy of ID, and agree about the name of the future company. The Notary is about to check the name availability with the Court Register.

The Notary certifies the Founding Act, i.e. certifies the signatures of the owner and responsible person. The certification per signature costs 7 notary points BAM 0.5 each + VAT = BAM 4.095

Procedure 2: Personal Documents and Signatures Certification

Visit City Hall and certify copies of ID cards/passports of the owner and responsible person (the certification costs are BAM 2 per sheet) and certify the signature of the future responsible person – BAM 10.

Procedure 3: Company Registration – One-Stop Shop at APIF

The notary/founder/responsible person files the registration application to APIF, including the required documents (notarized founding act, certified signature of responsible person, certified copies of ID cards/passports of owner and responsible person, The Tax Administration’s assurance that there are no due obligations and debts) – initial registration is free of charge;

Publication in the RS Official Gazette – BAM 7 per line, APIF fee BAM 35.

The completion deadline is 3 days if all required documentation is filed. The registration procedure implies simultaneous business entity registration with the RS Tax Administration, i.e. award of the TIN and business entities sorting in accordance with the activity classification.

STEP 2

Procedure 1: Company Registration

Taking the Court Certificate and Notification of Sorting in accordance with the activity classification from APIF.

Procedure 2: Stamp Making

Have the stamp made by an authorized stamp maker, upon submitting a copy of Court Decision and presenting the original. The stamp price is BAM 20.00 – 50.00, and it is made in a day.

STEP 3

After completion of the aforementioned steps, the company is obliged to make the following steps: VAT registration – visit the Indirect Taxation Authority of B&H for the purpose of VAT registration. Documents required:

• Registration request (ZR-1 application form);

• Court Register Decision;

• Registration of the business entity with the Tax Administration;

• ID of the owner and responsible persons;

• Work permit and residence permit for a foreign citizen; • Specimen signature card certified at the bank where the transaction account is opened;

• An original payment slip as a proof of BAM 40 paid (BIH JRT Treasury Account), as follows:

✓ BAM 10 – Remittance Purpose: Registration Request Fee

✓ BAM 10 – Remittance Purpose: Registration Decision Issuance Fee

✓ BAM 20 – Remittance Purpose: Registration Certificate Issuance Fee

STEP 4

Fiscalization – The Company has to have the cash register in order to operate. The cash register procurement, installation and servicing approximately costs BAM 1.000.

STEP 5

Employees Registration at the Tax Administration – visit the Tax Administration in order to register employees using form templates. The company can operate in the space which meets conditions in the field of protection and health at work. This Decree is issued by the Ministry of Labor, War Veterans and Disabled Persons’ Protection, and the republic fee is BAM 10.00.

REGISTRATION COSTS IN BAM (the simplest organization form)

• The notary 2 x BAM 4.095 + ID cards certification, 2 x BAM 2 + BAM 10 signature certification of the future responsible person

• APIF fee BAM 35

• Publication in the RS Official Gazette BAM 7 per line x 6 lines = BAM 42.00

• Stamp making – BAM 40.00

• TOTAL: BAM 139.19 + BIH Indirect Taxation Authority – BAM 40

Visit the following institutions:

• Notary

• City Hall Service Office

• APIF Counter

• Stamp Maker

• Indirect Taxation Authority BIH – regional center

• Cash Register Distributor

• RS Tax Administration for the purpose of employees registration.